Is Boeing's stock, represented by the ticker symbol BA, poised for a resurgence, or will it continue to navigate the turbulence of a challenging market? The consensus among analysts suggests a Strong Buy rating, projecting a potential 11.60% increase in the stock price over the next year, a figure that should certainly pique the interest of any investor with a pulse on the market.

The Boeing Company, a titan of the aerospace industry, is a subject of intense scrutiny in the financial world. Its stock performance, particularly on the New York Stock Exchange (NYSE) under the ticker BA, is closely monitored by investors, analysts, and the broader market. The company's fortunes are intertwined with complex global factors, including geopolitical events, supply chain dynamics, and, of course, the ever-present shadow of public perception and regulatory oversight. Examining the latest price quotes, real-time data, and analyst forecasts offers a glimpse into the current state and future potential of BA.

To provide a deeper understanding of The Boeing Company and its place in the financial landscape, here’s a table detailing key aspects:

The fluctuations in Boeing's stock price are influenced by a multitude of elements. News related to aircraft orders, production issues, and delivery schedules can have an immediate impact on the stock's value. Similarly, developments in the defense sector, including government contracts and geopolitical tensions, play a significant role. Investor sentiment, driven by broader economic trends and market volatility, adds another layer of complexity to understanding the stock's performance.

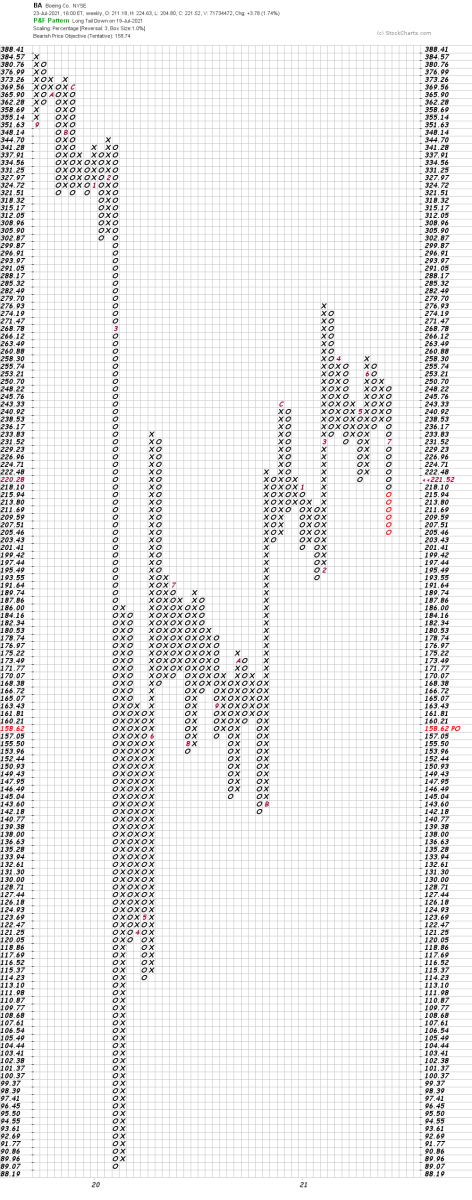

Real-time quotes from sources like Nasdaq and MarketWatch provide up-to-the-minute information on the stock's trading activity. This includes the current price, trading volume, and the day's high and low prices. These metrics are essential for short-term traders and investors monitoring the stock's intraday performance. Furthermore, access to the 52-week range gives a broader perspective on the stock's historical performance, allowing investors to gauge its volatility and potential growth trajectory.

Analyst ratings offer valuable insights into the market's perception of Boeing's future prospects. The Strong Buy rating, as reported by various sources, indicates that a majority of analysts believe the stock is undervalued and has significant potential for growth. These ratings are based on extensive research and analysis of the company's financial performance, market position, and industry trends. However, it is important to remember that analyst forecasts are not guarantees, and investors should conduct their own due diligence before making investment decisions.

The 12-month price forecast is a crucial metric for investors seeking to gauge the potential return on their investment. The projected price of $203.44 represents an increase from the current trading price, and it suggests that analysts are optimistic about Boeing's ability to overcome its current challenges and capitalize on future opportunities. This figure is particularly important for long-term investors who are willing to hold the stock for an extended period.

Boeing's stock is also heavily influenced by news and events. The company's performance is intricately tied to the health of the global airline industry, and any disruptions in air travel, such as economic downturns or geopolitical instability, can have a negative impact on its stock price. Conversely, positive news regarding new aircraft orders, technological advancements, or successful product launches can boost investor confidence and drive the stock price higher.

Zacks provides comprehensive stock information, including detailed quotes, stock data, charts, and statistics, which offer investors a deeper understanding of Boeing's financial performance. These resources are invaluable for conducting thorough research and making informed investment decisions. Similarly, Morningstar offers insightful data, including stock ratings, related news, valuation metrics, and dividend information. This information is particularly helpful for investors seeking to evaluate the stock's intrinsic value and potential for long-term growth.

The integration of real-time data from various sources, such as Google Finance and the Wall Street Journal (WSJ), provides investors with a complete picture of Boeing's stock performance. These platforms offer up-to-the-minute quotes, historical charts, and analyst ratings, which enable investors to stay informed about the latest market trends and make timely investment decisions. The ability to compare Boeing's performance with other stocks, ETFs, and indexes further enhances an investor's ability to assess its relative value and potential for growth.

The aerospace and defense industries are characterized by high barriers to entry, complex regulatory environments, and significant capital investments. Boeing's strong position in these sectors gives it a competitive advantage, but it also faces substantial challenges, including supply chain disruptions, workforce shortages, and the need for ongoing technological innovation. The company's ability to navigate these challenges will be critical to its long-term success and its stock performance.

For investors, the analysis of Boeing's stock requires a comprehensive approach. It is essential to consider not only the current stock price and analyst ratings, but also the broader economic and industry trends, the company's financial performance, and its long-term growth prospects. Access to real-time data from reliable sources such as MarketWatch and Google Finance is invaluable. Investors should also conduct their own research and due diligence before making any investment decisions. The potential for substantial returns is evident, but so is the inherent risk in the volatile world of stock trading. The decision to invest in Boeing, therefore, requires careful consideration and a clear understanding of the factors shaping its future.

In conclusion, while the path of The Boeing Company's stock is subject to the unpredictable winds of the market, current indicators suggest a promising outlook. The Strong Buy consensus among analysts, coupled with the 12-month price forecast, should offer a level of optimism to those investors who are willing to ride the potential turbulence. However, as with any investment, a thorough understanding of the risks and rewards is essential for informed decision-making. Staying abreast of real-time information, expert analysis, and industry developments will be critical to successfully navigating the future of BA in the ever-evolving aerospace sector.