Is SoFi Technologies (SOFI) poised for a comeback in the volatile financial markets? Despite recent gains and a surge in new customer acquisitions, the stock faces a complex landscape shaped by market analysts' forecasts and historical performance, demanding a thorough examination of its potential.

The financial technology sector, or Fintech, has experienced remarkable growth and transformation in recent years, and SoFi Technologies has positioned itself as a key player in this arena. The company offers a range of financial products and services, including lending, financial planning, and investment platforms, catering to a broad customer base seeking modern, technology-driven solutions. Recent market activity surrounding SoFi's stock, identified by the ticker symbol SOFI, has been the subject of increased scrutiny, particularly in the wake of recent earnings reports. These reports have indicated both positive developments, like a record number of new customers, and challenges, as reflected in analysts' forecasts and the stock's overall performance.

| Aspect | Details |

|---|---|

| Company Name | SoFi Technologies, Inc. |

| Ticker Symbol | SOFI (NASDAQ) |

| Industry | Financial Technology (Fintech) |

| Business Focus | Provides a range of financial products and services including: lending, financial planning, and investment platforms. |

| Recent Highlights | Record number of new customers (10.9 million members). |

| Analyst Rating (Average) | Hold (Based on 16 analysts) |

| 12-Month Stock Price Forecast (Average) | $12.82 (as of latest available data), a decrease of -3.39% from the latest price. |

| Recent Stock Performance | Stock has climbed in response to positive earnings, though still down from January peak. |

| Key Market Indicators | MarketWatch, Nasdaq, Yahoo Finance, Google Finance, and Morningstar all provide real-time stock quotes and financial information. |

| Real-time Updates | Nasdaq provides real-time updates on stock quotes, trades, and more. |

| Additional Information | Complete SoFi Technologies Inc. stock news available on MarketWatch. |

| Historical Data | Historical performance and charts are available on Google Finance. |

| Resources | SoFi Official Website |

Market sentiment towards SoFi has been mixed. While positive earnings have provided a lift, the stock's overall trajectory reveals a more complicated picture. The surge in new customer acquisitions, reaching a remarkable 10.9 million members, undoubtedly signals a growing user base and potential for future revenue generation. This growth is a key metric that investors closely monitor, reflecting the company's ability to attract and retain customers within a competitive market. However, the stock price's performance, particularly its decline from a peak in January, underscores the volatility and inherent risks associated with investing in the financial markets. The stock's climb in response to positive earnings is an indicator of investor optimism but must be evaluated in the context of the broader market environment.

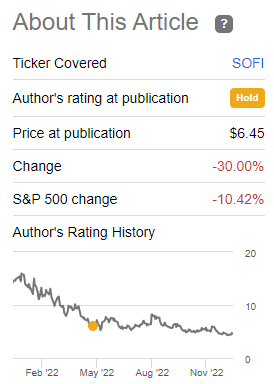

A critical aspect of assessing SoFi's investment potential lies in the analysis provided by financial analysts. According to a consensus of 16 analysts, the current rating for SOFI stock is Hold. This suggests a neutral stance, implying that the analysts believe the stock's price is likely to remain relatively stable in the short term. This evaluation must be considered alongside the projected 12-month stock price forecast, which stands at $12.82, representing a decrease compared to the latest price. This forecast, while providing a glimpse into potential future performance, is subject to market volatility, economic conditions, and changes in the company's performance, which are all factors that can influence an accurate prediction. The diverse range of analysts providing these insights represents differing interpretations and methodologies, making it essential to consider various perspectives when making investment decisions.

The availability of real-time data and information from leading financial platforms plays a crucial role in the investment decision-making process. Sources like MarketWatch, Nasdaq, Yahoo Finance, Google Finance, and Morningstar provide investors with vital information, including real-time stock quotes, news updates, historical performance data, and analyst ratings. These resources enable investors to stay informed about market movements, track stock performance, and make data-driven investment choices. Access to comprehensive financial information helps to clarify the overall picture of SoFi's market position, and the trends affecting its performance. The ability to access this information quickly and efficiently is essential for navigating the dynamic landscape of the financial markets.

The evolution of the Fintech sector continues to influence SoFi's strategy and prospects. The industry's growth, driven by technological advancements and changing consumer preferences, presents both opportunities and challenges. As consumer needs evolve, and the regulatory environment changes, SoFi must adapt its business model, offerings, and strategic direction to maintain competitiveness and drive long-term growth. Competitors, new entrants, and economic factors will impact SoFi, emphasizing the importance of thorough analysis and diligence in evaluating its investment potential.

In conclusion, the outlook for SoFi Technologies stock requires a nuanced perspective. Although positive developments such as a surge in new customers are encouraging, factors such as analyst ratings, historical performance, and market forecasts should be weighed. Investors must carefully consider the available financial information and the evolving Fintech landscape to make informed decisions.