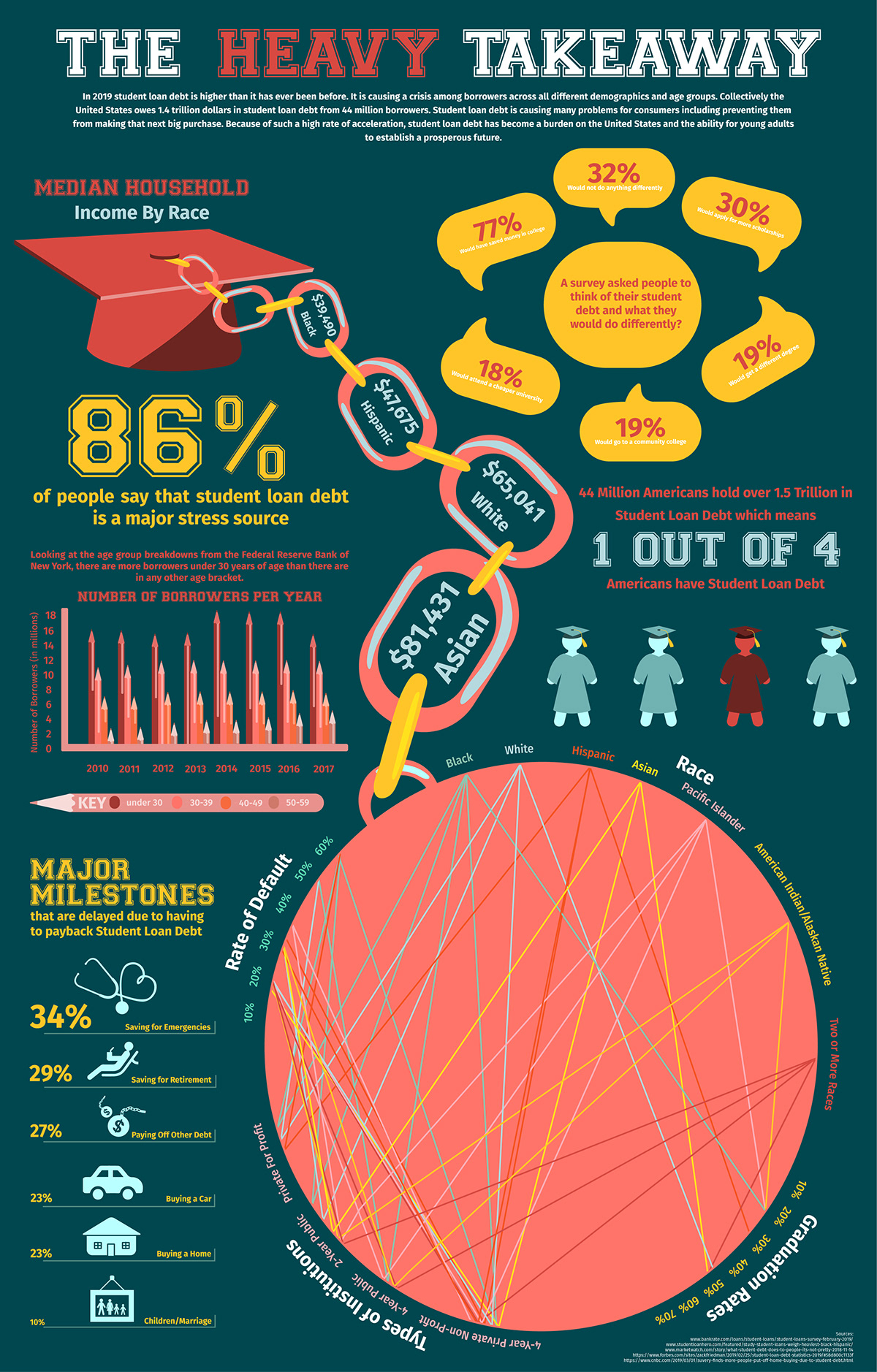

Is the weight of student loan debt crushing the dreams of a generation? The staggering $1.727 trillion owed by borrowers in the U.S. paints a clear picture: student loan debt is a defining financial challenge of our time.

The numbers, drawn from the Federal Reserve's Q4 2023 data, are stark. The average student loan debt for those with federal student loans currently stands at $37,056, according to the Department of Education's most recent figures from the same quarter. Within this colossal sum, federal loans account for a significant $1.602 trillion, as per the Federal Student Aid data. This financial burden is not evenly distributed; it is a complex issue, varying widely based on age, educational attainment, and geographic location. The restarting of collections, a pivotal moment, officially ending pandemic-era relief measures that initially provided some respite for borrowers. This marks a critical juncture, with the potential to dramatically reshape the financial landscape for millions.

| Category | Details |

|---|---|

| Total Student Loan Debt in U.S. (Q4 2023) | $1.727 trillion |

| Average Federal Student Loan Debt (Q4 2023) | $37,056 |

| Federal Student Loan Debt (Total) | $1.602 trillion |

| Age Group with Highest Debt (2025) | Borrowers aged 35-49 ($646.6 billion) |

| Age Group with Second Highest Debt (2025) | Borrowers aged 25-34 ($487.3 billion) |

| Median Student Loan Debt (Borrowers with Some College, No Bachelor's Degree) | Between $10,000 and $14,999 (2023) |

| Origin of Data (Federal Student Loans) | Federal Student Aid |

| Source for Average Student Loan Debt by Age (2025) | Ramsey Solutions |

| Average Student Loan Debt by State (2024 - Highest) | Washington, D.C. ($53,782) |

| Average Student Loan Debt by State (2024 - Lowest) | North Dakota ($28,921) |

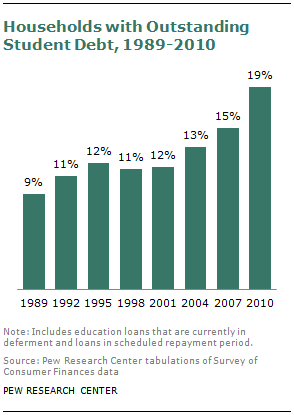

Delving deeper into the specifics, the distribution of student loan debt across different age groups reveals significant disparities. Borrowers aged 35-49 shoulder the heaviest burden, collectively owing a staggering $646.6 billion. The 25-34 age group follows closely, with $487.3 billion in outstanding debt. Even those aged 62 and older carry a substantial $121.5 billion in federal student loans. This data highlights the long-term financial implications of student debt, affecting individuals well into their careers and retirement years. The Pew Research Center's data also highlights the impact of educational attainment on debt levels. While the median borrower with outstanding student debt in 2023 owed between $20,000 and $24,999, those who attended some college but didn't complete a bachelor's degree typically owed between $10,000 and $14,999.

A crucial turning point arrived with the resumption of student loan debt collections, a move initiated in May. This marked the official end of the pandemic-era relief that had offered a temporary reprieve for many borrowers. The policy shift means that the millions of borrowers previously benefiting from paused payments and interest accrual are now once again subject to collections. This transition has understandably caused concern and uncertainty among borrowers, necessitating a thorough understanding of the implications and available options. The impact of these measures is considerable, impacting the financial well-being of a large segment of the population. The sheer scale of the debt, coupled with the potential consequences of collections, underscores the urgent need for comprehensive solutions and support for borrowers.

Geographically, the burden of student loan debt also varies significantly. According to 2024 data, the average student loan debt ranged from $28,921 in North Dakota to a considerable $53,782 in Washington, D.C. These figures highlight the regional disparities in student loan burdens. These differences might be attributed to factors such as the cost of living, tuition rates at local universities, and the availability of financial aid. This geographic variation underlines the need for tailored solutions at the state and local levels to address the unique challenges faced by borrowers in different regions.

The situation is further complicated by the impending return of collections for defaulted federal student loans. Millions of borrowers who have fallen behind on their payments face a complex set of challenges, including potential wage garnishment, tax refund offsets, and damage to their credit scores. The government has announced plans to start collecting payments for defaulted federal student loans, adding another layer of complexity for many borrowers. This restart of collections marks a significant shift from the pandemic era's relief measures, and it necessitates a careful approach to ensure borrowers have the resources and information they need to manage their debt effectively.

The cumulative effect of these factors—the sheer scale of the debt, its uneven distribution across age groups and geographies, and the resumption of collections—creates a complex financial ecosystem that impacts millions of Americans. It is a situation that demands careful analysis, informed policy decisions, and a commitment to providing borrowers with the support they need to navigate the challenges of student loan debt. The future of the economy, and the prospects of many individuals, are directly linked to the effective management and resolution of this massive financial undertaking.

The landscape of student loan debt is constantly evolving, necessitating continuous monitoring and assessment. The interplay of economic factors, policy changes, and individual circumstances determines the ultimate impact. Data from various sources, including the Federal Reserve, the Department of Education, and independent research organizations, reveals the intricate nature of the problem. Understanding these trends is crucial for policymakers, educators, and, most importantly, borrowers, as they navigate the complexities of student loan repayment and its long-term financial ramifications.